The future

The crystal ball – Examples of how digitalisation could develop in the rental industry and what the future might look like

05

THE FUTURE IS ALREADY HERE IN OTHER COMPARABLE INDUSTRIES:

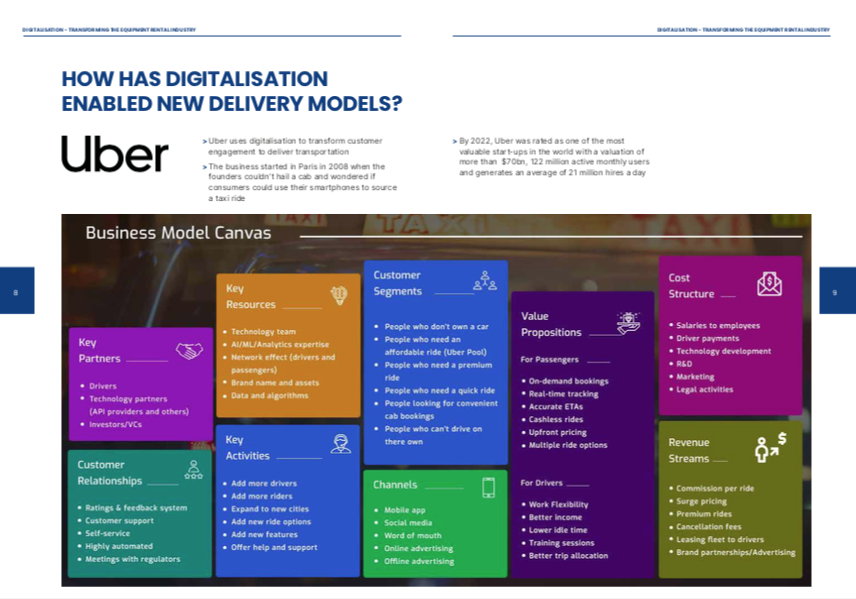

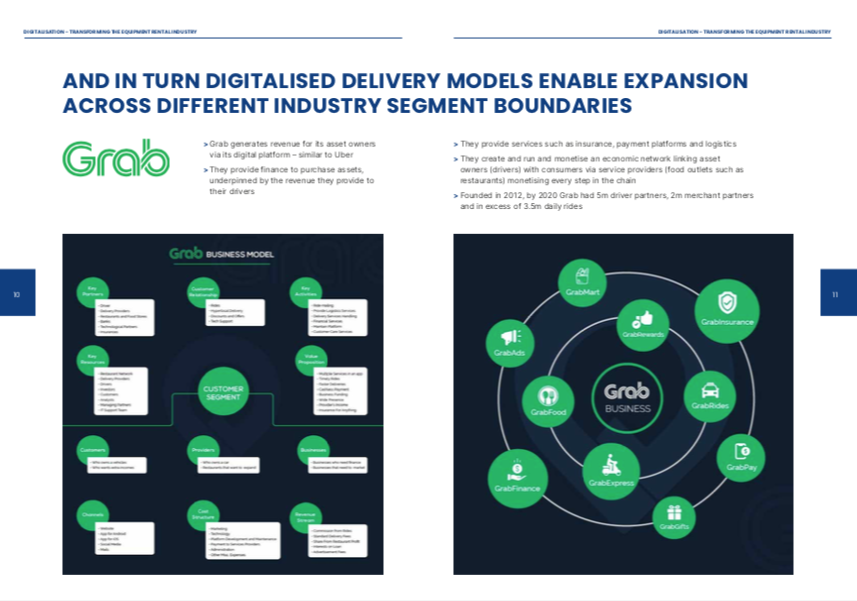

Fully digitalised businesses have been launched in other comparable industries such as asset sharing clubs (Zip Car), fully digitalised taxi services (Uber) and hybrid models (Grab) creating global businesses at scale within a small number of years – Zipcar, within 16 years, 1 million members and offers 10,000 vehicles across 500 cities in 9 countries – Uber, within 14 years with a valuation of more than $70bn, 122 million active monthly users and generates an average of 21million hires a day, plus new business models enabled by digitalisation such as Grab, which within 8 years has 5m driver partners, 2m merchant partners and in excess of 3.5m daily rides.

These digital models are directly applicable to the equipment rental industry and provide a vision of how the future could look within equipment rental.

THE FUTURE IS ALREADY HAPPENING NOW – THE ASSET RENTAL MARKET IS ALREADY TRANSFORMING INTO ASSET RENTAL AND SERVICE PROVISION DRIVEN BY CUSTOMER DEMAND, REGULATION AND SUPPLIER PUSH

- Major construction companies are looking to transform the efficiency and effectiveness of the construction industry

- Data will enable them to achieve this goal

- Rental is a key mechanism in providing data, and also developing asset rental into consultancy services

- Sustainability is a megatrend and rental is inherently sustainable (through circularity)

- Data provision (from assets) to calculate environmental impact will become increasingly important

- Rental companies will need to provide digitally enabled assets and calculate the environmental impact for their clients

- Asset manufacturers are providing digitally enabled assets and also COTS digitalisation solutions as they want to develop into providing data enabled services as an ongoing revenue stream

RENTAL COMPANIES BOTH VIRTUAL AND TRADITIONAL ARE DEVELOPING NEW APPROACHES TO RENTAL AND SHAPING THE WAY THE MARKET IS DEVELOPING

PLATFORMS

- Digital pure play solutions have been struggling to gain ground, however, hybrid solutions which combine multi channel (digital, phone, depot) have been gaining ground

- We expect that as the market matures, platform rental agencies will carve out an increasingly important place in the market

- The view formed during the research process for this report is that large rental companies with a market leading digitally enabled offer and digital enabled propositions, will continue to dominate the major customer segment, platforms will take share from large rental companies in the mid and craftsmen segments and also take share from SME companies in the craftsmen and mid market segments

TRADITIONAL RENTAL COMPANIES

- SMEs will need to develop a clear survival and growth strategy, based on specialisation, geographical strength and personalised service, and consider how they can compete in a digital world either through a carefully considered strategy of working with platforms or building solutions utilising COTS software

- Digital leaders in the rental industry are developing digital solutions in the areas of:

- Sustainability reporting

- Usage based pricing

- Subscribe to a complete service including fuelling, data, consultancy, site logistics and materials movement as well as equipment rental

SERVICES SUCH AS INSURANCE

- Digitalisation is forecast to change the game in areas such as insurance due to better risk assessment and asset access control – only allowing trained and approved asset users

- Digitalisation is transforming health and safety, compliance and environmental compliance and performance

- Credit control based on more accurate profiling of customers, leading to differential pricing for the more attractive rental customer

DEPOT

NETWORK

- Rental companies are using their digital solutions to take over and manage all assets on the site, their own and the customers

- Rental companies are experimenting with reducing their depot network (renting from on site asset stores) and direct from one customer to another, the industry expects to see the greater development of:

- Assets kept on site

- Creation of equipment pools

- Large depots become warehouses / second line maintenance and refurbishment

ASSET FLEET MANAGEMENT

Find out more about:

DIGITALISATION READINESS CHECKLIST

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Strategy

| Clear link between business strategy and digitalisation strategy (business strategy leads) |

See |

| Digitalisation strategy matches customer drivers in target segments | See Chapter 1 & Chapter 3 |

| Implementation strategy (in-house, COTS, platform, hybrid) matches capabilities and resources in the business | See Chapter 3 |

| Understanding the impact of digitalisation on your business mix, profitability, and ability to service non platform customers | See Chapter 1 |

| If relying on platform partnership for your delivery strategy, do you have a plan for what happens if the platform arrangement goes sour | See Chapter 3 |

Digitalisation delivery strategy

| Does the digitalisation delivery strategy – inhouse, COTS, platform, hybrid - match your strategy in terms of budgeting, “ownership” of customers, capabilities and likely development of digitalisation within your business over time? | See Chapter 3 |

| Does your IT delivery strategy and in particular budgeting over time, considered a transformation journey that is likely to include ERP replacement, telematics roll out and data analysis? | See Chapter 4 |

| Do you have the skills and capabilities required to deliver your digitalisation delivery strategy and journey over time, or you have a plan to address any skills and capability gaps? |

See |

Organisation of your digitalisation effort

| Is the business (relevant functions, operations, sales etc) involved and leading the strategy development and decision making for digital transformation? | See Chapter 4 |

| Are you running the digital transformation project as a business transformation project and not just an IT project? | See Chapter 4 |

| Do you have a clear business case for the digitalisation transformation? | See Chapter 4 |

| Have you aligned the tracking of benefits and results with business KPIs | See Chapter 4 |

Process digitalisation

| Do you have a strategy to bring your staff along with you and manage change and business transformation as you digitalise your business processes? | See Chapter 4 |

| Does your business process digitalisation strategy cover integration with operational aspects such as sales management, credit control, HR, QHSE? | See Chapter 4 |

| Does your process digitalisation strategy consider if, and when, you will need to update your ERP system? | See Chapter 4 |

Telematics implementation / data strategy

| Do you have a telematics implementation strategy – which assets, linkage to business processes and how to talk to different telematics solutions? | See Chapter 4 |

| Does your digitalisation strategy cover creation of a data lake / warehouse, analysis of data and development of new services and solutions? | See Chapter 4 & Chapter 5 |

| Does your digitalisation strategy cover the use of data to transform your business model in areas such as commercial offers, service delivery (depots) asset / fleet management etc? | See Chapter 4 & Chapter 5 |

Go to market / customer engagement

| Does you digitalisation strategy align with the different needs of different customer segments | See Chapter 1 |

| Have you engaged your digitalisation strategy to empower and transform your sales organisation (see implementation case study) | See Chapter 4 |

| Does your sales front end still allow for traditional (phone and in-depot and sales staff engagement) as well as digital engagement (Multi-channel engagement) | See Chapter 4 |

| Have you developed the customer journey and support you provide to educate and migrate customers onto digital platforms from traditional servicing |

See Chapter 4 |

Asset management

| Does your digitalisation strategy enable efficient and effective fleet management via data analysis and effective forecasting | See Chapter 2 & Chapter 4 |

| Does your digitalisation strategy provide data which will inform and drive your procurement decision making | See Chapter 2 & Chapter 4 |

| Does your digitalisation strategy deliver increased fleet availability via effective and efficient fleet maintenance | See Chapter 2 & Chapter 4 |

| Does your digitalisation strategy use data analysis to drive asset disposal | See Chapter 2 & Chapter 4 |

Proposition development

| Does your digitalisation strategy cover how you will reach and engage target market segments and drive customer acquisition | See Chapter 1 , Chapter 2 & Chapter 4 |

| Does your digitalisation strategy cover how you will drive customer retention and lock customers in | See Chapter 1 , Chapter 2 & Chapter 4 |

| Does your digitalisation strategy cover how you will develop added value services and propositions and develop additional revenue streams for your business | See Chapter 1 , Chapter 2 & Chapter 4 |

Business model development

| Does the digitalisation strategy go beyond customer engagement and sales, process transformation and solution development and create a vision of how the business can transform to capitalise on data and customer and market understanding | See Chapter 5 |

| Does the business strategy include scenario’s for how competitors may transform their business through digitalisation and how your business will respond | See Chapter 3, Chapter 4 & Chapter 5 |

| Does your digitalisation strategy align with the strategies of key customer segments and how digitalisation can support and enable your customers strategic development | See Chapter 1 , Chapter 2 & Chapter 4 |